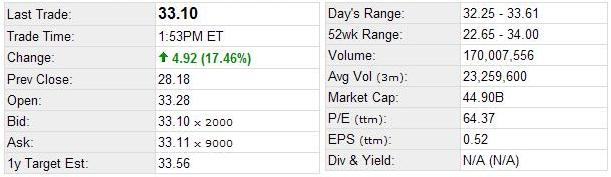

實力雄厚的 Carl Icahn,除了開罵以外,也擺明他不是只有一張嘴而已。公開信中聲稱,他已經花了十三億美金買了雅虎五千九百萬股 (大約佔雅虎 4% 股權)。而且他正在向美國聯邦交易委員會提出申請,希望得到反托拉斯的許可,以便買下價值二十五億美金的雅虎股權 (大約 8% 左右)。

Icahn 表示不只贊成微軟的購併案,而且也打算提案撤換雅虎的董事會 - 他已經公開提了一個十人名單,希望能夠在七月三號的雅虎股東年會上面,取得多數董事席位。十人都是赫赫有名,除了他自己以外,還包括:

Carl Icahn 這些舉動的背後,和微軟的 Steve Ballmer 有沒有什麼默契或是私下的合作,是很耐人尋味的。不過這是楊致遠和雅虎董事會要擔心的事情了。我們只要負責看連續劇看不到的好戲就好了啊! XD

話說回來,楊致遠接任 CEO 以後,風波總是不斷。他能夠有時間精力來做好公司重整的工作嗎?我很懷疑。光是應付微軟大巨獸想必就已經筋疲力竭了。現在又來一個 Carl Icahn,恐怕難得有一夜好眠了...

[註] Carl Icahn 是具有傳奇色彩的投資人。他以爭取股東權益聞名,令許多上市公司老闆聞之色變。最近的事蹟是投資摩托羅拉事件。他所投資的公司,通常伴隨著大規模的重整,包括經營階層的重新洗牌與裁員。

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY Carl C. Icahn AND HIS AFFILIATES FROM THE STOCKHOLDERS OF YAHOO! INC. FOR USE AT ITS ANNUAL MEETING, WHEN AND IF THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN ANY SUCH PROXY SOLICITATION. WHEN AND IF COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF YAHOO! INC. AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION'S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE POTENTIAL PARTICIPANTS IN A POTENTIAL PROXY SOLICITATION IS CONTAINED IN EXHIBIT 1 TO THE SCHEDULE 14A BEING FILED TODAY WITH THE SECURITIES AND EXCHANGE COMMISSION.

Carl C. Icahn

ICAHN CAPITAL LP

767 Fifth Avenue, 47th Floor

New York, NY 10153

May 15, 2008

Roy Bostock

Chairman

Yahoo! Inc.

701 First Avenue

Sunnyvale, CA 94089

Dear Mr. Bostock:

It is clear to me that the board of directors of Yahoo has acted irrationally and lost the faith of shareholders and Microsoft. It is quite obvious that Microsoft's bid of $33 per share is a superior alternative to Yahoo's prospects on a standalone basis. I am perplexed by the board's actions. It is irresponsible to hide behind management's more than overly optimistic financial forecasts. It is unconscionable that you have not allowed your shareholders to choose to accept an offer that represented a 72% premium over Yahoo's closing price of $19.18 on the day before the initial Microsoft offer. I and many of your shareholders strongly believe that a combination between Yahoo and Microsoft would form a dynamic company and more importantly would be a force strong enough to compete with Google on the Internet.

During the past week, a number of shareholders have asked me to lead a proxy fight to attempt to remove the current board and to establish a new board which would attempt to negotiate a successful merger with Microsoft, something that in my opinion the current board has completely botched. I believe that a combination between Microsoft and Yahoo is by far the most sensible path for both companies. I have therefore taken the following actions: (1) during the last 10 days, I have purchased approximately 59 million shares and share-equivalents of Yahoo; (2) I have formed a 10-person slate which will stand for election against the current board; and (3) I have sought antitrust clearance from the Federal Trade Commission to acquire up to approximately $2.5 billion worth of Yahoo stock. The biographies of the members of our slate are attached to this letter. A more formal notification is being delivered today to Yahoo under separate cover.

While it is my understanding that you do not intend to enter into any transaction that would impede a Microsoft-Yahoo merger, I am concerned that in several recent press releases you stated that you intend to pursue certain "strategic alternatives". I therefore hope and trust that if there is any question that these "strategic alternatives" might in any way impede a future Microsoft merger you will at the very least allow shareholders to opine on them before embarking on such a transaction.

I sincerely hope you heed the wishes of your shareholders and move expeditiously to negotiate a merger with Microsoft, thereby making a proxy fight unnecessary.

Sincerely yours,

CARL C. ICAHN

SLATE BIOGRAPHIES

Lucian A. Bebchuk

Lucian Bebchuk is the William J. Friedman and Alicia Townsend Friedman Professor of Law, Economics, and Finance and Director of the Program on Corporate Governance at Harvard Law School. Bebchuk is also a Research Associate of the National Bureau of Economic Research and Inaugural Fellow of the European Corporate Governance Network. Trained in both law and economics, Bebchuk holds an LL.M. and S.J.D. from Harvard Law School and an M.A. and Ph.D in Economics from the Harvard Economics Department. He joined the Harvard Law School faculty in 1986 as an assistant professor, becoming a full professor in 1988, and the Friedman Professor of Law, Economics and Finance in 1998. Bebchuk has written extensively on corporate governance, corporate control, and corporate transactions. He has published more than seventy research articles in academic journals in law, economics, and finance. Upon electing him to membership in 2000, the American Academy of Arts and Sciences cited him as "[o]ne of the nation's leading scholars of law and economics," who "has made major contribution to the study of corporate control, governance, and insolvency." He is the 2007-2008 President of the American Law and Economics Association, and a former chair of the Business Association Section of the American Association of Law Teachers. Bebchuk's recent writings include Pay without Performance: the Unfulfilled Promise of Executive Compensation (Harvard University Press, 2004, co-authored with Jesse Fried), "The Case for Increasing Shareholder Power" (Harvard Law Review, 2005), "The Costs of Entrenched Boards" (Journal of Financial Economics, 2005, co-authored with Alma Cohen), and "The Myth of the Shareholder Franchise" (Virginia Law Review, 2007). Bebchuk has been a frequent contributor to policy making and public discourse in the corporate governance area. He has appeared before the Senate Finance Committee, the House Committee of Financial Services, and the SEC. He has published many op-ed pieces, including in the Wall Street Journal, the New York Times, and the Financial Times. He was included in the list of "100 most influential people in finance" of Treasury & Risk Management and the list of "100 most influential players in corporate governance" of Directorship magazine.

Frank J. Biondi, Jr.

Since March 1999, Mr. Biondi has served as Senior Managing Director of WaterView Advisors LLC, an investment advisor organization. From April 1996 to November 1998, Mr. Biondi served as Chairman and Chief Executive Officer of Universal Studios, Inc. From July 1987 to January 1996, Mr. Biondi served as President and Chief Executive Officer of Viacom, Inc. Mr. Biondi is a director of Amgen Inc., Cablevision Systems Corp., Hasbro, Inc., The Bank of New York Mellon Corporation and Seagate Technology. Mr. Biondi is a graduate of Princeton University and earned a Masters of Business Administration from Harvard University.

John H. Chapple

John Chapple is President of Hawkeye Investments LLC, a privately-owned equity firm investing primarily in telecommunications and real estate ventures frequently working in conjunction with Rally Capital LLC. Prior to forming Hawkeye, John Chapple worked to organize Nextel Partners, a provider of digital wireless services in mid-size and smaller markets throughout the U.S. He became the President, Chief Executive Officer and Chairman of the Board of Nextel Partners and its subsidiaries in August of 1998. Nextel Partners went public in February 2000 and was traded on the NASDAQ Exchange. In June 2006, the company was purchased by Sprint Communications. From 1995 to 1997, Mr. Chapple was the President and Chief Operating Officer for Orca Bay Sports and Entertainment in Vancouver, B.C. During Mr. Chapple's tenure, Orca Bay owned and operated Vancouver's National Basketball Association and National Hockey League sports franchises in addition to the General Motors Place sports arena and retail interests. From 1988 to 1995, he served as Executive Vice President of Operations for McCaw Cellular Communications and subsequently AT&T Wireless Services following the merger of those companies. From 1978 to 1983, he served on the senior management team of Rogers Cablesystems before moving to American Cablesystems as Senior Vice President of Operations from 1983 to 1988. Mr. Chapple, a graduate of Syracuse University and Harvard University's Advanced Management Program, has 26 years of experience in the cable television and wireless communications industries. Mr. Chapple is the past Chairman of Cellular One Group and CTIA-The Wireless Association, past Vice-Chairman of the Cellular Telecommunications Industry Association and has been on the Board of Governors of the NHL and NBA. Mr. Chapple serves on the Syracuse University Board of Trustees currently as Chairman and the Advisory Board for the Maxwell School of Syracuse University. He is also on the Board of Directors of Cbeyond, Inc., a publicly traded Atlanta-based integrated service telephony company; Seamobile Enterprises, a privately held company providing integrated wireless services at sea; Telesphere, a privately held VOIP (voice over internet protocol) company based in Phoenix, Arizona; and on the advisory boards of Diamond Castle Holdings, LLC, a private equity firm based in New York City and the Daniel J. Evans School of Public Affairs at University of Washington.

Mark Cuban

Since early 2000, Mr. Cuban has been the majority and controlling owner of the National Basketball Association franchise, the Dallas Mavericks. In 2001, Mr. Cuban co-founded HDNet, an all high-definition television network on DIRECTV that broadcasts high-definition sports, movies and other entertainment. Prior to his purchase of the Dallas Mavericks, Mr. Cuban co- founded Broadcast.com in 1995 and served as its Chairman of the Board until it was sold to Yahoo! in July of 1999. Before Broadcast.com, Mr. Cuban co-founded MicroSolutions, a national systems integrator, in 1983, which was later sold to CompuServe Corporation in 1990. Mr. Cuban is an active investor in cutting- edge technologies and various industries, including the entertainment industry.

Adam Dell

Since January 2000, Mr. Dell has served as the Managing General Partner of Impact Venture Partners, a venture capital firm focused on information technology investments. He also serves as Managing Director at Steelpoint Capital Partners, a private equity firm with offices in New York and California. From October 1998 to January 2000, Mr. Dell was a Senior Associate and subsequently a Partner with Crosspoint Venture Partners in Northern California. From July 1997 to August 1998, he was a Senior Associate with Enterprise Partners in Southern California. From January 1996 to June 1997 Mr. Dell was associated with the law firm of Winstead Sechrest & Minick, in Austin, Texas, where he practiced corporate law. Mr. Dell's investments include: Buzzsaw (which was acquired by Autodesk), HotJobs (which was acquired by Yahoo!) and Connectify (which was acquired by Kana Software). Mr. Dell has been a director of XO Holdings, Inc., a telecommunications services provider, since February 2006, and of its predecessor from January 2003 to February 2006. In addition, Mr. Dell currently serves on the boards of directors of the Santa Fe Institute, MessageOne and OpenTable. He also teaches a course at the Columbia Business School on business, technology and innovation and is a contributing columnist to the technology publication, Business 2.0. Mr. Dell received a J.D. from University of Texas and a B.A. from Tulane University.

Carl C. Icahn

Mr. Icahn has served as chairman of the board and a director of Starfire Holding Corporation, a privately-held holding company, and chairman of the board and a director of various subsidiaries of Starfire, since 1984. Since August 2007, through his position as Chief Executive Officer of Icahn Capital LP, a wholly owned subsidiary of Icahn Enterprises L.P., and certain related entities, Mr. Icahn's principal occupation is managing private investment funds, including Icahn Partners LP, Icahn Partners Master Fund LP, Icahn Partners Master Fund II L.P. and Icahn Partners Master Fund III L.P. Prior to August 2007, Mr. Icahn conducted this occupation through his entities CCI Onshore Corp. and CCI Offshore Corp since September 2004. Since November 1990, Mr. Icahn has been chairman of the board of Icahn Enterprises G.P. Inc., the general partner of Icahn Enterprises L.P. Icahn Enterprises L.P. is a diversified holding company engaged in a variety of businesses, including investment management, metals, real estate and home fashion. Mr. Icahn was chairman of the board and president of Icahn & Co., Inc., a registered broker- dealer and a member of the National Association of Securities Dealers, from 1968 to 2005. Mr. Icahn has served as chairman of the board and as a director of American Railcar Industries, Inc., a company that is primarily engaged in the business of manufacturing covered hopper and tank railcars, since 1994. From October 1998 through May 2004, Mr. Icahn was the president and a director of Stratosphere Corporation, the owner and operator of the Stratosphere Hotel and Casino in Las Vegas, which, until February 2008, was a subsidiary of Icahn Enterprises L.P. From September 2000 to February 2007, Mr. Icahn served as the chairman of the board of GB Holdings, Inc., which owned an interest in Atlantic Coast Holdings, Inc., the owner and operator of The Sands casino in Atlantic City until November 2006. Mr. Icahn has been chairman of the board and a director of XO Holdings, Inc., a telecommunications services provider, since February 2006, and of its predecessor from January 2003 to February 2006. Mr. Icahn has served as a Director of Cadus Corporation, a company engaged in the ownership and licensing of yeast-based drug discovery technologies since July 1993. In May 2005, Mr. Icahn became a director of Blockbuster Inc., a provider of in-home movie rental and game entertainment. In October 2005, Mr. Icahn became a director of WestPoint International, Inc., a manufacturer of bed and bath home fashion products. In September 2006, Mr. Icahn became a director of ImClone Systems Incorporated, a biopharmaceutical company, and since October 2006 has been the chairman of the board of ImClone. In August 2007, Mr. Icahn became a director of WCI Communities, Inc., a homebuilding company, and since September 2007 has been the chairman of the board of WCI. In December 2007, Mr. Icahn became a director of Federal-Mogul Corporation, a supplier of automotive products, and since January 2008 has been the chairman of the board of Federal-Mogul. In April 2008, Mr. Icahn became a director of Motricity, Inc., a privately-held company that provides mobile content services and solutions. Mr. Icahn received his B.A. from Princeton University.

Keith A. Meister

Since March 2006, Keith Meister has served as Principal Executive Officer and Vice Chairman of the Board of Icahn Enterprises G.P. Inc., the general partner of Icahn Enterprises L.P., a diversified holding company engaged in a variety of businesses, including investment management, metals, real estate and home fashion. Since November 2004, Mr. Meister has been a Managing Director of Icahn Capital LP, the entity through which Carl C. Icahn manages third party private investment funds. Since June 2002, Mr. Meister has served as senior investment analyst of High River Limited Partnership, an entity primarily engaged in the business of holding and investing in securities. Mr. Meister also serves on the boards of directors of the following companies: XO Holdings, Inc., a telecommunications company; WCI Communities, Inc., a homebuilding company; Federal-Mogul Corporation, a supplier of automotive products; and Motorola, Inc., a mobile communications company. With respect to each company mentioned above, Carl C. Icahn, directly or indirectly, either (i) controls such company or (ii) has an interest in such company through the ownership of securities. Mr. Meister received an A.B. in government, cum laude, from Harvard College in 1995.

Edward H. Meyer

Mr. Meyer serves as Chairman, Chief Executive Officer and Chief Investment Officer of Ocean Road Advisors, Inc., an investment management company. From 1970 to 2006, he served as Chairman, Chief Executive Officer and President of Grey Global Group, Inc., a multi-billion dollar global advertising and marketing agency. Mr. Meyer serves as a Director of Harman International Industries, Inc., Ethan Allen Interiors, Inc., National CineMedia, Inc. and NRDC Acquisition Corp. Mr. Meyer holds a B.A. in Economics from Cornell University.

Brian S. Posner

Brian S. Posner is a private investor. From 2005 through March 2008, he served as Chief Executive Officer and co-Chief Investment Officer of ClearBridge Advisors LLC (and its predecessor company, CAM North America), an asset management company based in New York with approximately $90 billion in assets and a wholly owned subsidiary of Legg Mason Inc. Prior to ClearBridge Advisors, he was a co-Founder and the Managing Partner of Hygrove Partners LLC, a hedge fund company that was formed in 2000. Prior to ClearBridge Advisors and Hygrove Partners, he served as a Portfolio Manager and an Analyst, first at Fidelity Investments from 1987 to 1996 and then at Warburg Pincus Asset Management/Credit Suisse Asset Management from 1997 to 1999. At Warburg Pincus Asset Management/Credit Suisse Asset Management he was a Managing Director and served as the Senior Investment Manager of the Value Equity Group, co-Portfolio Manager of the Warburg Pincus Growth & Income Fund, and Portfolio Manager of the Warburg Pincus Institutional Value Fund and the Warburg Pincus Trust, Growth and Income Fund. Prior to the acquisition of Warburg Pincus Asset Management ("WPAM") by Credit Suisse Asset Management in July 1999, he was co-Chief Investment Officer, Director of Research, Chairman of the Global Asset Allocation Committee, and a member of the Executive Operating Committee at WPAM. At Fidelity Investments, he was the Portfolio Manager of the Fidelity Equity Income II Fund from 1992 to 1996 and the Fidelity Value Fund from 1990 to 1992. He also managed the Select Life Insurance, Select Property Casualty Insurance and Select Energy Portfolios. From 1987 to 1990, he was an Oil, Insurance, and Financial Services Analyst. From August 2000 to April 2003 he served on the Board of Directors for Sotheby's Holdings, Inc. He currently a member of the Board of Trustees at Northwestern University and the Board of Visitors for the Weinberg College of Arts and Sciences at Northwestern University. Mr. Posner received his undergraduate degree in history from Northwestern University in 1983 and his M.B.A. in finance from the University of Chicago Graduate School of Business in 1987.

Robert K. Shaye

Robert Shaye is Co-Chairman and Co-CEO of New Line Cinema. As the Founder of New Line Cinema and a filmmaker himself, Robert Shaye has spent more than 40 years developing and distributing films that reflect a wide array of cultural movements, creating new paradigms for the motion picture business, and most importantly, entertaining millions of moviegoers. Since he founded New Line in 1967, Shaye has guided the company's growth from a privately-held art film distributor to one of the entertainment industry's leading independent studios and a veritable box office force. He has been involved in such films as The Lord of the Rings trilogy, Rush Hour, Austin Powers and Seven. A University of Michigan graduate with a degree in business administration and a J.D. degree from Columbia University Law School, Shaye is also a Fulbright Scholar, member of the New York State Bar, and serves on the Board of Trustees of the Motion Picture Pioneers, and the American Film Institute.